Página teste ENG – Dividendos

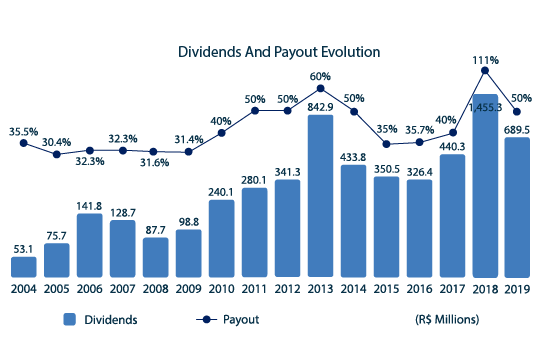

The table below shows the dividends or interest attributed to equity paid to the holders of the Company’s common and preferred shares:

| Year | Net Income (R$ mi) |

Net Income per Share (R$) | Dividends (R$ mi) |

Dividends per Share (R$) | Payout | Dividend Yield |

|---|---|---|---|---|---|---|

| 2004 | 150 | 2.27 | 53 | 0.80 | 35% | 11.8% |

| 2005 | 249 | 3.23 | 76 | 0,98 | 30% | 11.8% |

| 2006 | 460 | 5.99 | 142 | 1.85 | 31% | 8.3% |

| 2007 | 420 | 1.82 | 129 | 0.56 | 31% | 2.5% |

| 2008 | 290 | 1.26 | 88 | 0.38 | 30% | 2.9% |

| 2009 | 318 | 1.34 | 99 | 0.42 | 31% | 2.1% |

| 2010 | 623 | 1.90 | 240 | 0.73 | 39% | 2.6% |

| 2011 | 580 | 1.78 | 280 | 0.86 | 48% | 4.0% |

| 2012 | 683 | 2.10 | 341 | 1.05 | 50% | 4.5% |

| 2013 | 1.405 | 4.35 | 843 | 2.61 | 60% | 8.8% |

| 2014 | 876 | 2.71 | 434 | 1.34 | 50% | 4.4% |

| 2015 | 1.002 | 3.10 | 351 | 1.08 | 35% | 3.8% |

| 2016 | 916 | 2.83 | 326 | 1.01 | 36% | 3.8% |

| 2017 | 1.101 | 3.41 | 440 | 1.36 | 40% | 3.7% |

| 2018 | 1.311 | 4.05 | 1,455 | 4.50 | 111% | 8.6% |

| 2019 | 1.379 | 4.27 | 690 | 2.13 | 50% | 3.4% |

The preferred shares were converted into common shares at the ratio of 1:1 on October 27, 2004.

The common shares were split at the ratio of 1:3 in March 2008.

98,292,519 shares were issued in November 2009, due to the association with Itaú-Unibanco.

Also in 2009, 1,293,600 shares were repurchased and cancelled afterwards with no capital reduction.

In 2011, 2,972,600 shares were repurchased and cancelled afterwards in March 2012, with no capital reduction.

In 2012, 1,376,100 shares were repurchased and cancelled afterwards in March 2013, with no capital reduction.

In 2013 distributed dividends were impacted by the non-recurring effects of the COFINS tax lawsuit gain.

In 2018, extraordinary dividends were distributed with a value of R$ 500 million, aiming to increase the Company‘s capital efficiency.

In 2019, 378,700 common shares issued by the company were rebought to be held in treasury and subsequently sold or canceled without reduction of capital.