Corporate Presentation

Overview

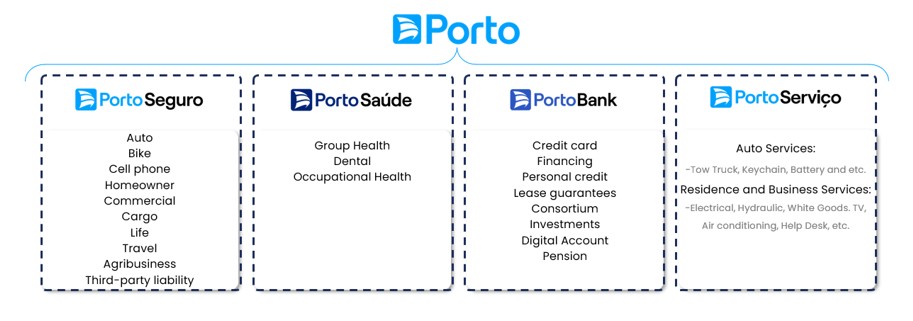

Porto is more than an insurance company; it is an ecosystem of technology-based service and protection solutions, recognized for its excellence in customer and broker service and the quality of its services.

The Company has four business verticals: Porto Seguro, Porto Saúde, Porto Bank and Porto Serviço, and has 18 million unique clients, 14 thousand employees, 13 thousand service providers and 46 thousand independent brokers. The Company has branches and regional offices throughout Brazil. Porto’s universe also includes Azul Seguros, Itaú Seguros de Auto e Residência and Porto Seguro Uruguay, among others. In 2024, the Company reported R$ 37 billion in revenue and R$ 2.7 billion in net income.

Porto’s history began in 1945, with the sale of insurance in the city of São Paulo. At that time, the Company was very small, ranked as the 44th largest insurance company in Brazil with only 25 employees

In 1972, the Company was acquired by the Garfinkel family, which continues to control the operation to this day.

In 2003, the Company expanded its operations in the insurance market through the acquisition of Azul Seguros, then called AXA Brasil, a subsidiary of the French multinational insurance company AXA, primarily offering auto insurance.

In the following year (2004), Porto Seguro S.A. went public (IPO), and began trading its shares on the Novo Mercado, a special segment of the B3 stock market that includes companies with high corporate governance standards.

In 2009, Porto Seguro S.A. entered into a strategic partnership with Itaú Unibanco Holding S.A., initiating a business combination involving home and auto insurance operations. With this agreement, Porto obtained exclusivity to offer and distribute these products through Itaú’s sales channels. This merger allowed the two companies to combine their standards of excellence, offering products better suited to meet the needs of different market segments, through the brands Porto Seguro, Itaú Auto e Residência and Azul Seguros.

The business combination between the two companies changed the corporate structure of Porto Seguro S.A., so that today the controlling block is composed of the Garfinkel family and Itaú Unibanco, which hold 40.4% and 30.4% of the shares, respectively, while the remaining 29.2% are publicly traded on the stock exchange.

In 2021, Porto segmented its business into four verticals: Insurance, Healthcare, Bank and Services, and subsequently created the brands Porto Seguro, Porto Saúde, Porto Bank and Porto Serviço. This new structure aims to increase autonomy and focus in each business, enhancing solutions that drive operational growth.

Over the years, the Company has launched several innovative products and solutions that are synergistic with the insurance business, enabling greater customer loyalty.

Among the products in its portfolio, the highlights are:

As a pioneer in the development of a wide range of products and services, the Company launched the anti-theft markings and devices, brake light installation, the creation of the insured’s profile for risk underwriting analysis, the launch of the Proteção Combinada product (Car+Home), automotive service centers, and bicycle assistance. The Company also developed new processes to improve service, through the 24-hour Call Center.

Among Porto’s launches in recent years, the highlights are Azul por Assinatura and Auto Fácil Itaú, subscription-based insurance offerings with more affordable prices and the potential to expand the market by reaching clients who do not yet have auto insurance; Aluguel Essencial, a rental guarantee product that is more agile, digital and cost-effective when compared to the traditional product; Porto Serviço, which offers assistance services for Automobiles and Homes in the B2C model and strategic B2B2C partnerships; and innovative health plans, with more selective high-quality networks and, consequently, more attractive prices.

In recent years, Porto has also carried out M&A operations, such as the acquisition of a stake in Segfy, a provider of technological and innovative solutions for brokers; the transaction with Petlove, which involved the transfer of Porto.Pet (veterinary medicine services); the acquisition of a stake in ConectCar, one of the main companies in the segment of automatic payments in toll roads, parking lots, drive-thrus and other services, through tags; an agreement with Oncoclínicas to offer a comprehensive care model to cancer patients, ensuring high standard experience in the treatment journey, excellent assistance and operational efficiency; a coinsurance agreement with Mitsui Sumitomo covering its auto, residential and small and medium-sized insurance products; and the merger of Porto Assistência with CDF, a B2B assistance company with major market players as clients; and the acquisition of Unigás, a company that installs and provides technical assistance related to gas heating systems.

These steps and achievements endorse the Company’s conviction in the path it is taking and in the strong and genuine connections it fosters with its employees, clients, brokers, suppliers, service providers and investors. There are millions of people who give Porto the privilege of being by their side, protecting their lives, families, homes, cars, accounts and businesses. Porto’s mission is to improve and evolve its operations daily to honor these commitments, always with the purpose of caring for and driving the dreams of more and more people.

To access the institutional presentation, click here.